This has been an incredible week (15 trading days to be precise). The SPY is down 20% and the futures are currently locked limit down for the open tomorrow. Volatility has been breathtaking with overnight futures locked both limit up and limit down and circuit breakers during the day being hit twice.

Oh, and now our cities are going to look like scenes from the Walking Dead. Great.

Obviously, COVID-19 has been the primary catalyst for this but an oil price war certainly hasn’t helped – I know it feels like a long time ago but it was just last Monday that oil dropped 30% in one day.

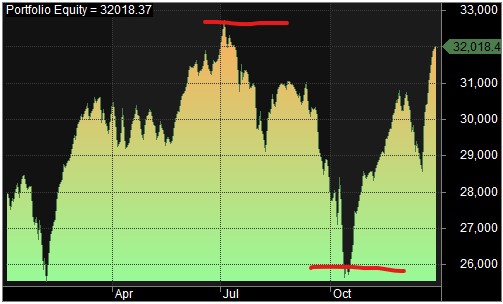

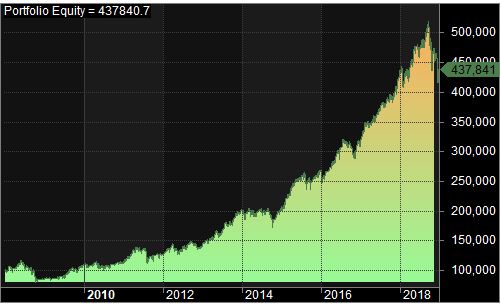

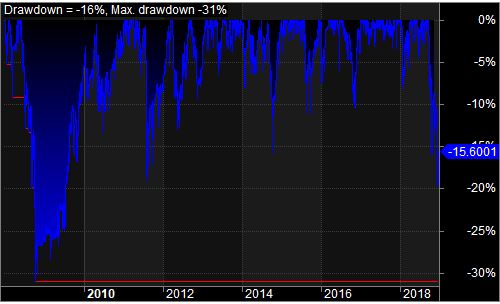

I’d like to tell you that my systems reacted perfectly and everything is smooth sailing. But I can’t – After a nearly 40% return last year, my primary system is in a 23% drawdown. Its not fun. I guess the positive is that now I know I can actually handle a drawdown that large. It’s one thing to say you can handle a certain amount of volatility but it’s quite another to live through it.

As many of you know, my primary system right now is a “buy the dip” mean reversion type, I’ve gone back again to see how it performed in previous large market drops. In general while it still experienced a drawdown it was muted compared to the overall market. I think the reason it hasn’t performed as well this time is just the shear velocity of this move. In the others there were several periods of drops and then some up or sideways activity where the exit signals were triggered. Haven’t seen that much in this move.

So what now? In my specific case I’m going to trade the signals as they come. At least until a 25% drawdown on a closing basis. At that point I’ll execute a stop on the system and take it down. I’ve also been throwing on a few call credit spreads in the SPY just to hedge the downside a bit. I do think we’ll stabilize and return to a more normal market dynamic but I have no idea when that will be.

The best advise I can give anyone in this market is if you can be on the sidelines in cash, that is probably the best place to be. You may miss out on the initial rally back but there may be substantially more downside before that happens.