In my last post I mentioned that for most systems I don’t want to experience greater than around a 20% drawdown. The main reason for that is I tend to get more emotionally involved at that point than I should. This is the point where I would start to think I should ignore my systems and start to go with some gut decisions (never a good idea).

But there’s a mathematical reason for limiting drawdowns to 20% or less as well. First let’s define what drawdown is: the drop in account equity relative to the highest equity achieved prior to the drawdown.

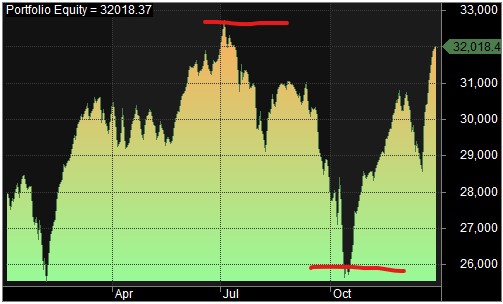

In this example there’s almost a 20% drop from the peak of the equity in July to the trough in October. Unfortunately as the next chart shows there is not a symmetric relationship between the loss and the gain required to recover from it:

| Drawdown Percent | Recovery Percent |

| 5 | 5.3 |

| 10 | 11.1 |

| 15 | 17.6 |

| 20 | 25 |

| 25 | 33.3 |

| 30 | 42.9 |

| 35 | 53.8 |

| 40 | 66.7 |

| 45 | 81.8 |

| 50 | 100 |

| 55 | 122 |

| 60 | 150 |

So to recover from that 20% drawdown requires a gain of 25%. That’s not an unreasonable amount but it’s still probably going to take a while. As you increase the drawdown the amount to recover increases more. At a 40% drawdown (not unusual for many trend following systems) you’ll need to gain 66% just to get to breakeven. That’s hard to stomach (for me anyway).

The more you can limit drawdown the less volatile your system will be and the less it will actually need to make to increase your equity. Of course every system is going to have some drawdown – There has to be some risk for the reward. But smaller is almost always better.